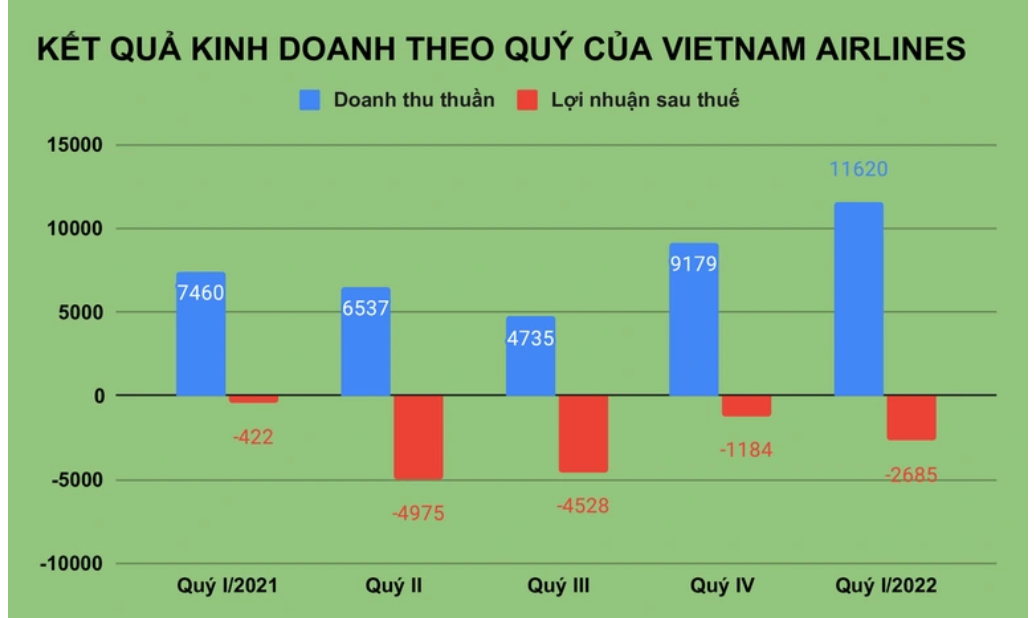

Vietnam Airlines continued to lose VND2,685 billion in the first quarter of the year, dragging accumulated losses to VND24,575 billion (more than US$1 billion).

After several days of late submission, Vietnam Airlines Corporation (Vietnam Airlines, stock code: HVN) has just released its consolidated financial statements for the first quarter with net revenue of VND11,620 billion, an increase of 55% over the same period in 2021. This is also the company’s highest revenue since the second quarter of 2020.

Structurally, domestic shipping revenue increased by 96% and international shipping increased by 71%. In the opposite direction, booking revenue decreased by 21%.

However, the situation of selling capital higher than revenue caused the national airline to lose a gross loss of VND 1,594 billion. In the period, Vietnam Airlines suffered additional financial costs of more than VND 528 billion, sales costs of VND365 billion and business management costs of VND390 billion.

After deducting other expenses, the airline recorded a profit after tax of negative VND 2,685 billion. This is also the 9th consecutive quarter of losses for Vietnam Airlines.

Vietnam Airlines said the first quarter production and business results clearly reflected the heavy impact of the pandemic lasting from 2021 to the beginning of this year, although vietnam’s aviation market recovered quite quickly. At the same time, the international market in the first 3 months of the year is almost still frozen, negatively affected by the Russian-Ukrainian conflict, rising fuel prices have made its operations unable to flourish.

By the end of March 31, Vietnam Airlines owed more than VND66,176 billion, of which short-term debt amounted to VND45,672 billion, more than three times its short-term assets. Notably, the Vietnamese aviation giant accumulated losses of more than VND24,575 billion (more than US$1 billion); Negative equity of VND 2,160 billion.

According to the provisions of Decree 155, shares of public companies will be delisted mandatory if production and business results are lost for 3 consecutive years, or the total accumulated loss exceeds the actual charter capital contributed, or negative equity in the most recent audited financial statements before the time of review. However, the basis for considering delisting is the full-year audited financial statements.

On the stock exchange, HVN shares of Vietnam Airlines are under control and traded at VND18,400 per share after the end of the session on May 20. Since the beginning of the year, HVN’s share price has fallen by 21%.

Previously, Vietnam Airlines cited the reason that officials and employees were quarantined due to Covid-19, so there were not enough accountants and asked to postpone the submission of financial statements in the first quarter, however, the State Securities Commission did not approve.

HOANG ANH – LINKPIZ.COM